When Disney recently released summer 2020 itineraries I jumped on an itinerary that makes not one, but two stops (a double dip) at Disney’s private…

So last month I ended up planning a last minute Disney World trip with my son which you can hear about on the Disney Deciphered…

I was excited to hear that Disney’s Free Dining Promotion was going to be offered for our upcoming Labor Day weekend trip to Disney World,…

We’ve touted the value of agency exclusive offers in the past. We’ve been doing “research” (read: planning trips) for August 2019 so we thought we’d…

This website had the unfortunate timing of launching right when Chase ended the ability to book Disney packages. While you could still book all things…

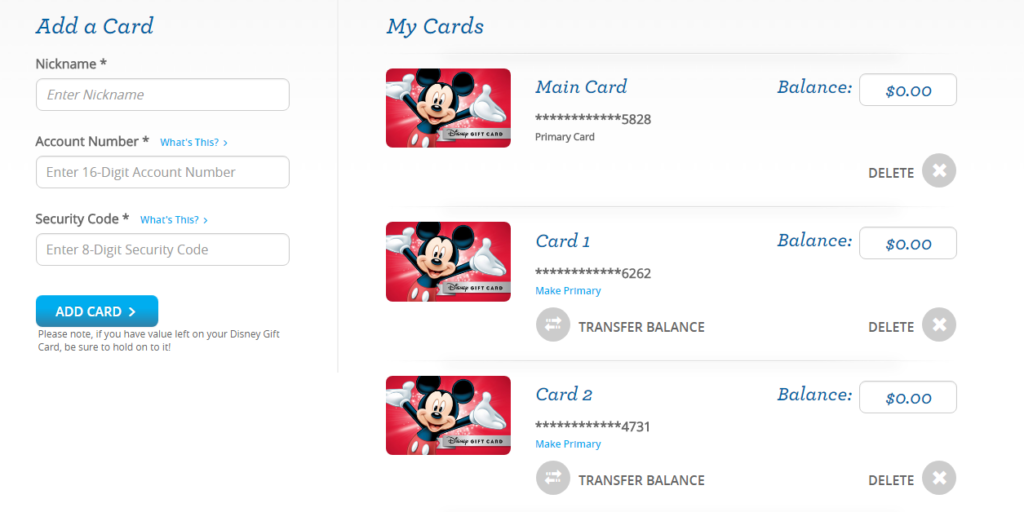

If you’ve taken advantage of some of the discounted Disney gift card deals that we’ve posted, you probably have a nice stack of cards that…

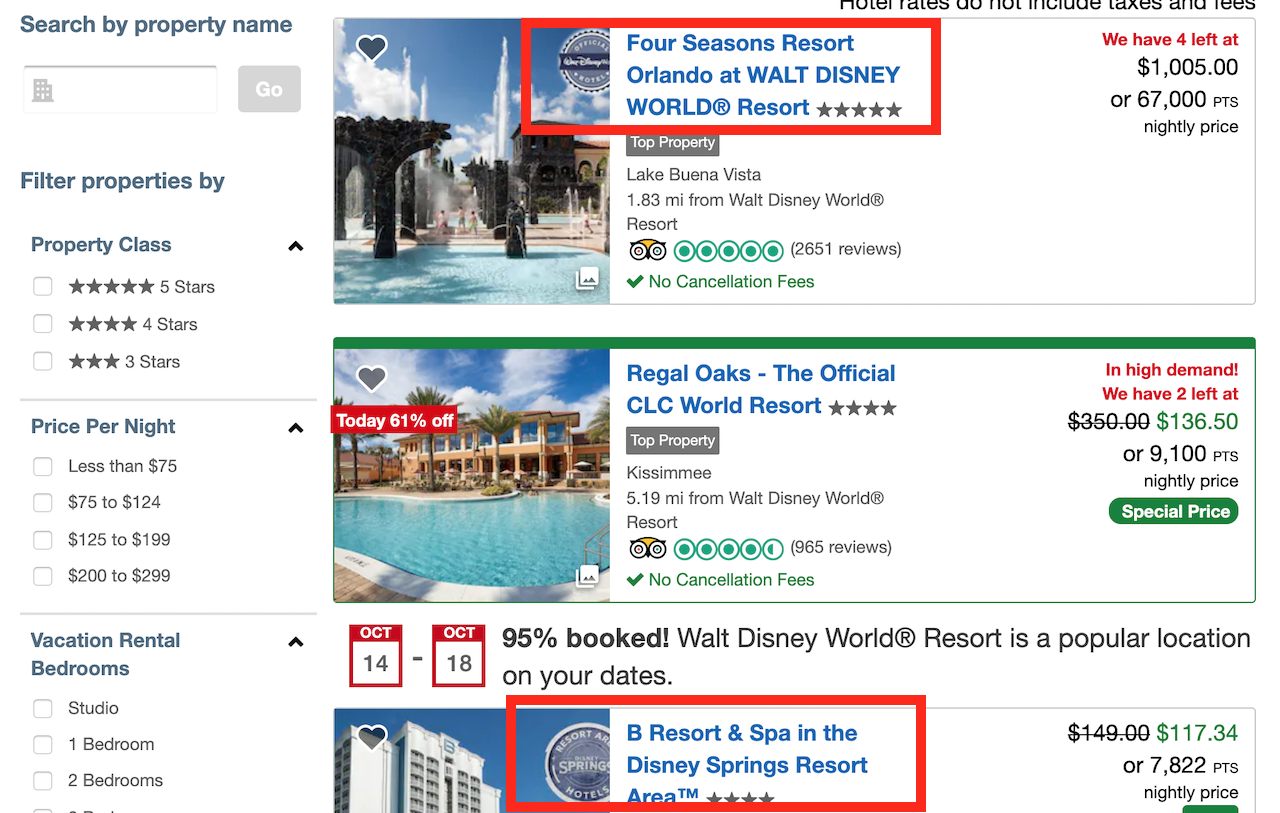

How to book Disney tickets on the Chase travel portal and how much it will cost you

A couple of weeks ago, Points to Neverland wrote about a backdoor method for booking Disney World tickets on the Chase travel portal. At the…

Earning and Using Citi ThankYou Points for Disneyland Vacation Packages

I recently booked a 3-night stay at Disney’s Grand Californian with 3-Day Parkhopper tickets entirely with Citi ThankYou Points. Here at Miles to the Magic…

Disney gift cards for up to 26% off with Stop & Shop/Giant

We won’t always post Disney gift card deals on the site, but this deal warrants one. If you want to keep abreast of the Disney…

How to use Happy cards for Disney gift card discounts – Guide

We didn’t set out to be so focused on Disney gift cards, but since we lost Chase we’ve had to adapt our Disney savings strategies.…